accumulated earnings tax form

The tax code imposes this penalty tax on C corporations with large accumulations of cash based upon the theory that companies holding. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

Improperly Accumulated Earnings Tax Iaet Summary Of Corporate Income Taxation Youtube

Accumulated Earnings Tax Form will sometimes glitch and take you a long time to try different solutions.

. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. _____ FOR NEW JERSEY. The accumulated earnings tax is a penalty tax.

1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and profits computation and the Schedule M-1 or Schedule M-3. Closely held corporations b. Improperly Accumulated Earnings Tax IAET Return.

Tax-exempt organizations Publicly held corporations assume it fails the stock ownership test. Recently the Tax Court had an opportunity to consider the. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

Your tax advisor knows your financial situation and can best assist you in choosing how to receive your benefit and minimize the tax you pay on this income. Purpose of Form IT-221 Use Form IT-221 to determine any amount of disability income that could have been excluded from federal adjusted gross income based on Internal Revenue Code IRC. To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535.

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. These retained earnings which are not paid out to shareholders in the form of dividends appear in the shareholders equity section of the companys financial report. Every domestic corporation branch of a foreign corporation.

LoginAsk is here to help you access Accumulated Earnings Tax Form quickly and. However if a corporation allows earnings to accumulate. We will mail checks to qualified applicants as.

The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your companys.

Oct 2018 Final Preboard No Answer File File File File Final Pre Board Taxation Instructions Studocu

What Are Accumulated Earnings Definition Meaning Example

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal

1120s Data Flow For Forms 6765 And 8941 M2

Doing Business In The United States Federal Tax Issues Pwc

How To Prepare An S Corporation Tax Return Online Tax Professionals

Earnings And Profits Computation Case Study

1120s504 Form 1120 S Income Tax Return For An S Corporation Page 5 Nelcosolutions Com

Determining The Taxability Of S Corporation Distributions Part I

Unappropriated Retained Earnings Meaning How Does It Work

Are Retained Earnings Taxed For Small Businesses

What Is The Accumulated Earnings Tax Kershaw Vititoe Jedinak Plc

Business Tax Quick Guide Tax Year 2021

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Irs Expands On Reporting Expenses Used To Obtain Ppp Loan Forgiveness On Form 1120s Schedule M 2 Current Federal Tax Developments

How Do You Resolve An S Corporation Tax Return That Requires Prior Year Adjustments Youtube

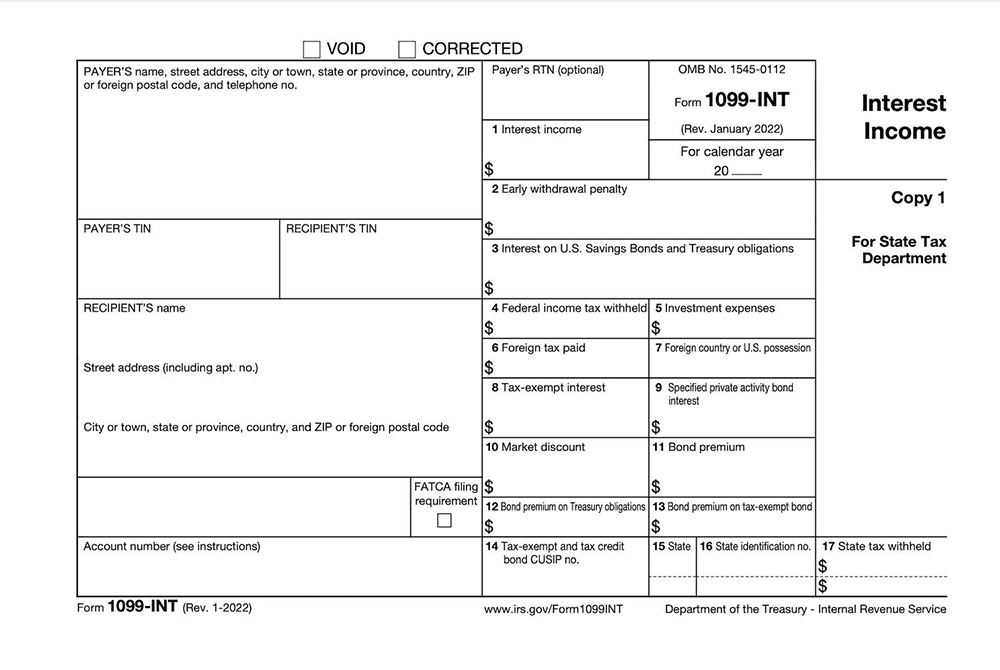

Tax Information Regarding Forms 1099 R And 1099 Int That We Send